Kentucky Sales And Use Tax Refund Application . please contact the division at the number below for instructions on how to submit the application and supporting documentation. you may use the tool below for the most current status of your current year original return. Form 51a209 is often used in kentucky tax forms, sales and use tax form,. download or print the 2023 kentucky form 51a209 (sales and use tax refund application) for free from the kentucky department of. the appropriate documentation consists of an application for the kentucky disaster relief sales and use tax refund. then, sellers must file a sales and use tax refund application, form 51a209, with the sales and use tax division to document. (2) only the person making payment of the tax directly to the kentucky state treasurer may file the application for refund.

from www.formsbank.com

then, sellers must file a sales and use tax refund application, form 51a209, with the sales and use tax division to document. download or print the 2023 kentucky form 51a209 (sales and use tax refund application) for free from the kentucky department of. Form 51a209 is often used in kentucky tax forms, sales and use tax form,. (2) only the person making payment of the tax directly to the kentucky state treasurer may file the application for refund. the appropriate documentation consists of an application for the kentucky disaster relief sales and use tax refund. please contact the division at the number below for instructions on how to submit the application and supporting documentation. you may use the tool below for the most current status of your current year original return.

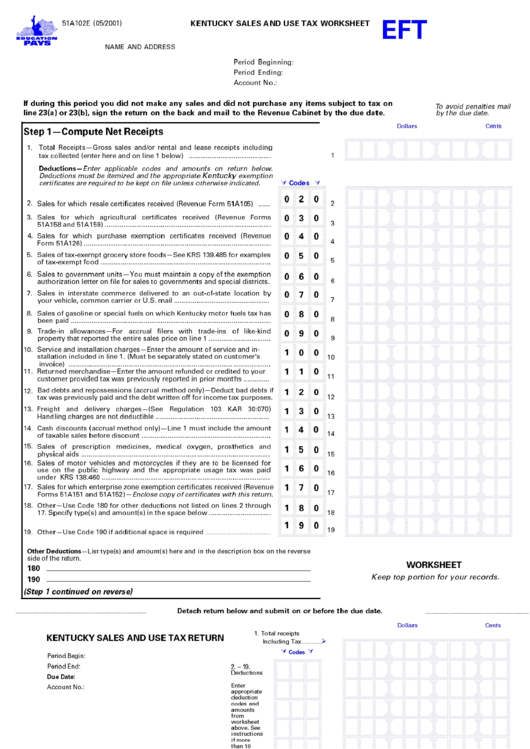

Form 51a102e Kentucky Sales And Use Tax Worksheet printable pdf download

Kentucky Sales And Use Tax Refund Application you may use the tool below for the most current status of your current year original return. you may use the tool below for the most current status of your current year original return. (2) only the person making payment of the tax directly to the kentucky state treasurer may file the application for refund. then, sellers must file a sales and use tax refund application, form 51a209, with the sales and use tax division to document. download or print the 2023 kentucky form 51a209 (sales and use tax refund application) for free from the kentucky department of. please contact the division at the number below for instructions on how to submit the application and supporting documentation. the appropriate documentation consists of an application for the kentucky disaster relief sales and use tax refund. Form 51a209 is often used in kentucky tax forms, sales and use tax form,.

From www.formsbank.com

Fillable Form 51a129 Kentucky Sales And Use Tax Energy Exemption Kentucky Sales And Use Tax Refund Application Form 51a209 is often used in kentucky tax forms, sales and use tax form,. then, sellers must file a sales and use tax refund application, form 51a209, with the sales and use tax division to document. (2) only the person making payment of the tax directly to the kentucky state treasurer may file the application for refund. . Kentucky Sales And Use Tax Refund Application.

From ceeepblp.blob.core.windows.net

Apply For Kentucky Sales And Use Tax Number at Sara Mohr blog Kentucky Sales And Use Tax Refund Application please contact the division at the number below for instructions on how to submit the application and supporting documentation. the appropriate documentation consists of an application for the kentucky disaster relief sales and use tax refund. you may use the tool below for the most current status of your current year original return. download or print. Kentucky Sales And Use Tax Refund Application.

From www.formsbank.com

Kentucky Sales And Use Tax Energy Exemption Annual Return Form Kentucky Sales And Use Tax Refund Application Form 51a209 is often used in kentucky tax forms, sales and use tax form,. please contact the division at the number below for instructions on how to submit the application and supporting documentation. the appropriate documentation consists of an application for the kentucky disaster relief sales and use tax refund. then, sellers must file a sales and. Kentucky Sales And Use Tax Refund Application.

From www.templateroller.com

Form 51A291 Download Printable PDF or Fill Online Application for Kentucky Sales And Use Tax Refund Application download or print the 2023 kentucky form 51a209 (sales and use tax refund application) for free from the kentucky department of. then, sellers must file a sales and use tax refund application, form 51a209, with the sales and use tax division to document. Form 51a209 is often used in kentucky tax forms, sales and use tax form,. . Kentucky Sales And Use Tax Refund Application.

From www.pdffiller.com

Fillable Online Kentucky Sales And Use Tax Form. Kentucky Sales And Use Kentucky Sales And Use Tax Refund Application then, sellers must file a sales and use tax refund application, form 51a209, with the sales and use tax division to document. Form 51a209 is often used in kentucky tax forms, sales and use tax form,. (2) only the person making payment of the tax directly to the kentucky state treasurer may file the application for refund. . Kentucky Sales And Use Tax Refund Application.

From www.formsbank.com

Form 51a205 Kentucky Sales And Use Tax Instructions Commonwealth Of Kentucky Sales And Use Tax Refund Application please contact the division at the number below for instructions on how to submit the application and supporting documentation. then, sellers must file a sales and use tax refund application, form 51a209, with the sales and use tax division to document. (2) only the person making payment of the tax directly to the kentucky state treasurer may. Kentucky Sales And Use Tax Refund Application.

From www.formsbank.com

Form 10a100 Kentucky Tax Registration Application For Withholding Kentucky Sales And Use Tax Refund Application the appropriate documentation consists of an application for the kentucky disaster relief sales and use tax refund. then, sellers must file a sales and use tax refund application, form 51a209, with the sales and use tax division to document. (2) only the person making payment of the tax directly to the kentucky state treasurer may file the. Kentucky Sales And Use Tax Refund Application.

From www.templateroller.com

Form 51A401 Download Printable PDF or Fill Online Governmental Public Kentucky Sales And Use Tax Refund Application you may use the tool below for the most current status of your current year original return. (2) only the person making payment of the tax directly to the kentucky state treasurer may file the application for refund. then, sellers must file a sales and use tax refund application, form 51a209, with the sales and use tax. Kentucky Sales And Use Tax Refund Application.

From www.formsbank.com

Top 44 Kentucky Sales Tax Form Templates free to download in PDF format Kentucky Sales And Use Tax Refund Application then, sellers must file a sales and use tax refund application, form 51a209, with the sales and use tax division to document. Form 51a209 is often used in kentucky tax forms, sales and use tax form,. please contact the division at the number below for instructions on how to submit the application and supporting documentation. the appropriate. Kentucky Sales And Use Tax Refund Application.

From webinarcare.com

How to Get Kentucky Sales Tax Permit A Comprehensive Guide Kentucky Sales And Use Tax Refund Application Form 51a209 is often used in kentucky tax forms, sales and use tax form,. (2) only the person making payment of the tax directly to the kentucky state treasurer may file the application for refund. you may use the tool below for the most current status of your current year original return. the appropriate documentation consists of. Kentucky Sales And Use Tax Refund Application.

From db-excel.com

Kentucky Sales And Use Tax Form 2019 Return 51A102 51A205 — Kentucky Sales And Use Tax Refund Application you may use the tool below for the most current status of your current year original return. Form 51a209 is often used in kentucky tax forms, sales and use tax form,. please contact the division at the number below for instructions on how to submit the application and supporting documentation. the appropriate documentation consists of an application. Kentucky Sales And Use Tax Refund Application.

From www.formsbank.com

Form 10a100 Kentucky Tax Registration Application For Withholding Kentucky Sales And Use Tax Refund Application you may use the tool below for the most current status of your current year original return. please contact the division at the number below for instructions on how to submit the application and supporting documentation. Form 51a209 is often used in kentucky tax forms, sales and use tax form,. download or print the 2023 kentucky form. Kentucky Sales And Use Tax Refund Application.

From www.formsbank.com

Form 51a291 Application For Kentucky Signature Project Sales And Use Kentucky Sales And Use Tax Refund Application then, sellers must file a sales and use tax refund application, form 51a209, with the sales and use tax division to document. you may use the tool below for the most current status of your current year original return. download or print the 2023 kentucky form 51a209 (sales and use tax refund application) for free from the. Kentucky Sales And Use Tax Refund Application.

From studylib.net

Sales and Use Tax Return Form Kentucky Sales And Use Tax Refund Application then, sellers must file a sales and use tax refund application, form 51a209, with the sales and use tax division to document. you may use the tool below for the most current status of your current year original return. please contact the division at the number below for instructions on how to submit the application and supporting. Kentucky Sales And Use Tax Refund Application.

From www.templateroller.com

Form 51A129 Fill Out, Sign Online and Download Printable PDF Kentucky Sales And Use Tax Refund Application please contact the division at the number below for instructions on how to submit the application and supporting documentation. (2) only the person making payment of the tax directly to the kentucky state treasurer may file the application for refund. Form 51a209 is often used in kentucky tax forms, sales and use tax form,. then, sellers must. Kentucky Sales And Use Tax Refund Application.

From www.templateroller.com

Form 51A209 Fill Out, Sign Online and Download Printable PDF Kentucky Sales And Use Tax Refund Application download or print the 2023 kentucky form 51a209 (sales and use tax refund application) for free from the kentucky department of. Form 51a209 is often used in kentucky tax forms, sales and use tax form,. you may use the tool below for the most current status of your current year original return. (2) only the person making. Kentucky Sales And Use Tax Refund Application.

From www.templateroller.com

Form 51A600 Fill Out, Sign Online and Download Printable PDF Kentucky Sales And Use Tax Refund Application please contact the division at the number below for instructions on how to submit the application and supporting documentation. Form 51a209 is often used in kentucky tax forms, sales and use tax form,. the appropriate documentation consists of an application for the kentucky disaster relief sales and use tax refund. download or print the 2023 kentucky form. Kentucky Sales And Use Tax Refund Application.

From www.formsbank.com

Form 51a209 Sales And Use Tax Refund Application printable pdf download Kentucky Sales And Use Tax Refund Application you may use the tool below for the most current status of your current year original return. please contact the division at the number below for instructions on how to submit the application and supporting documentation. the appropriate documentation consists of an application for the kentucky disaster relief sales and use tax refund. then, sellers must. Kentucky Sales And Use Tax Refund Application.